/

/

Demystifying CSDDD

/

ISSB's IFRS S1/S2

/

Trends 2024 Report

/

5 steps to comply

/

The Great Equalizer

Report

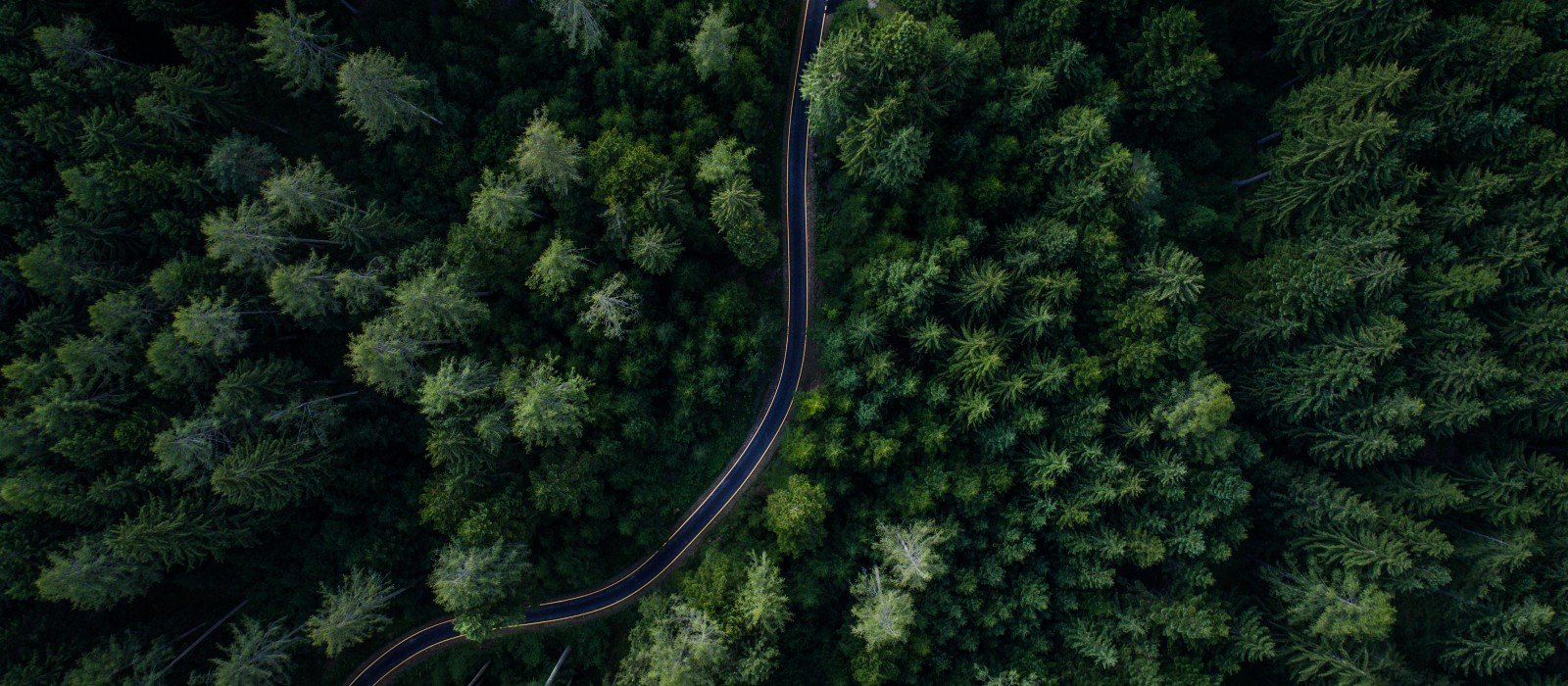

Renewables Conundrums - Renewable(s) Resilience: Four steps to bolster renewable energy supply chains

Renewables must grow further still if the world is to achieve net zero by 2050 and the Paris Agreement’s 1.5°C target.

Blog

A Clear Path to Decarbonizing Your Company

Prior to COP28, the world’s emissions trajectory remains far off track to meet the Paris Agreement’s goals, and all stakeholders need to ramp up their decarbonization efforts.

Blog

ISSB's first act

ISSB’s much-awaited inaugural standards bring more clarity and consolidation to the sustainability disclosure field.

Blog

The Rising Role of Cybersecurity in ESG and How Companies Are Taking Action

In today’s data-driven world, cybersecurity has emerged as one of the biggest threats to the global economy and is one of the top risks facing businesses worldwide.