Ageing mines, together with evolving community needs, increased M&A pressures, more extensive assessment of ESG credentials, and rising interest rates are just some of the issues that are reshaping mine closure.

Mining companies that don’t recognize these shifts and act accordingly risk being left with an unmanageable closure process, characterized by high costs, poor value creation and adverse environmental outcomes. The winners will be those that prepare and think more strategically, which will benefit their bottom line and establish more prosperous post-mining economies and healthier local ecosystems for years to come.

Closure costs are escalating

Mining is an expensive business. The finite lifespan of producing mines, coupled with the sunk costs involved in extracting valuable minerals and resources, means that mining companies need to be certain of extracting value from their operations.

For many companies, focusing on the continued productivity of their mining assets has yet to force them to fully consider and prepare for the reality of the end of the mining lifecycle. However, the list of mines that are nearing the end of their productive life is increasing. A 2018 survey by the International Council on Mining and Metals found that around 20% of mines sites were expected to close within the next 10 years. With efforts to shift to a global low-carbon energy system increasing, closure of coal mines is accelerating. And with more mines reaching closure, investor and stakeholder scrutiny of how mining companies manage closures is also intensifying.

The industry has a poor track record on managing mine closure. The technical challenges (both in environmental and engineering terms) are significant, as are commercial, social and regulatory factors. Advance forecasts of closure costs spread across these areas are often inaccurate, on account of limited detail and numerous assumptions in the basis of estimate associated with both active closure approaches and post-closure management of the site. In some jurisdictions, estimates of closure costs are put together solely to satisfy financial assurance requirements, resulting in the use of outdated methods, along with calculations that only address limited aspects of site closure.

All of this means companies often lack the clarity they need to manage the financial, environmental and social implications of mine closure. ERM’s analysis of closure programmes suggests that an underestimation of costs in the order of 4-10 times is common in the mining sector. Information reported by mining companies such as Rio Tinto, BHP, Vale and Anglo American in their annual reports show that mining liabilities increased by around $1bn or more over the 2013 to 2020 period.

Improving mine closure

Companies will be able to better manage the financial costs, as well as the social and environmental outcomes, of mine closure by developing a more accurate understanding of the issues and uncertainties around closure throughout the life of mine and in particular as they approach the end of operations.at the planning stage.

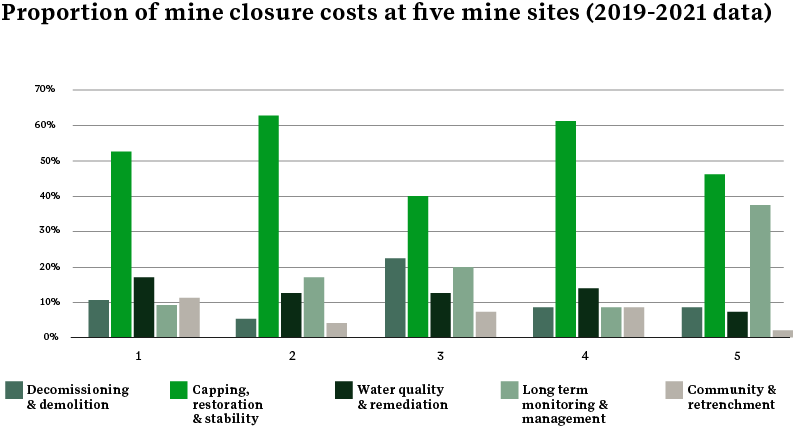

ERM analysis of mine closures, shows that costs tend to fall under five main categories. A large proportion of spend is associated with earthworks (i.e. capping, restoration & stability) and significant sums are also spent on decommissioning and demolition, water quality & remediation, long-term monitoring and management and community engagement and employee redundancies. The graph below shows percentage closure costs per issue across five minesining sites:

Source: ERM analysis

To manage these issues effectively, closure needs to be planned ahead of the mine’s end of life. Closure issues need to be built into initial mine planning and design as well as regularly evaluated throughout the life of mineand implementation, with regular horizon scanning to assess future trends, regulatory requirements, risks and opportunities.

Key actions that, if properly implemented, could help develop a more cost-effective and sustainable closure programme include:

- Building pollution prevention mechanisms and better waste deposition controls into the design stage of mine planning and expansionsclosure. For example, advanced characterization of materials and alignment within mine planning and materials deposition management can prevent the generation of acidic waters - this approach reduces costs relating to the need for cover systems.

- A circular economy approach to materials. This could entail looking at alternate markets for solutions to waste, such as construction and aggregate supply - sand is being used at its fastest rate ever and sustainable supplies are diminishing - or separating minerals from wastewater and use these as pigments. Waste materials can also be used in soil enhancement.

- Better wastewater design. Sympathetic watershed management and nature-based treatment allow for alternate approaches for wastewater treatment, which provide low-cost solutions and opportunities for enhanced biodiversity.

- Creating shared value to spur the transition to new and more effective ownership models. Shared value can be built by considering the mine’s asset base in a different light e.g., access to land, water, materials, buildings and other elements, in which non-miners may see value. Repurposing these assets under new ownership, for example reusing land for low carbon energy generation or agriculture, can offer alternative sources of income to both mining companies and local communities, while reducing remediation or demolition costs.

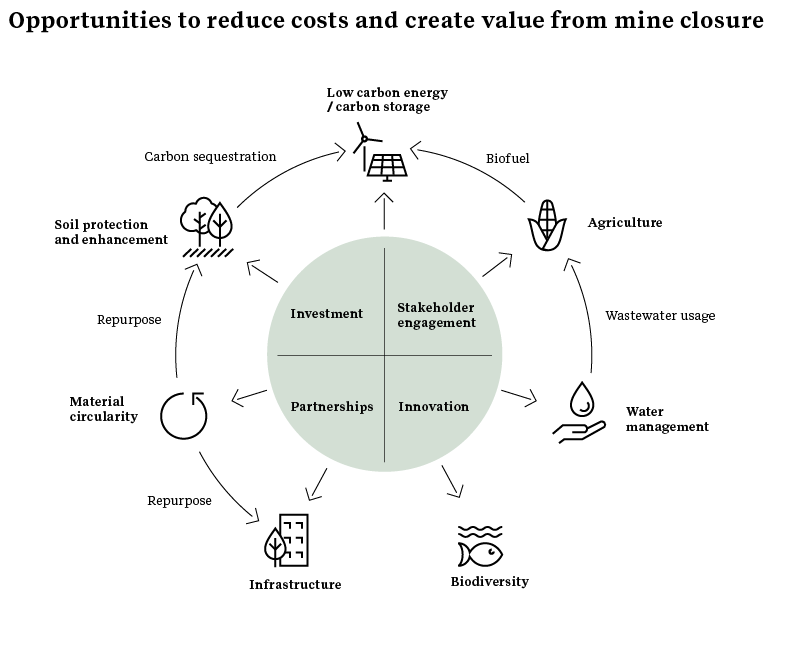

The diagram below outlines potential opportunities for mining companies to create environmental, social and financial value, as well as reduce the costs of mine closure, by leveraging innovation, stakeholder engagement, partnerships and investment during the closure planning process. These opportunities, if planned well, can also interact to create further value:

Source: ERM

Managing closure costs

Mining companies can prevent closure costs from spiralling by developing more accurate probabilistic cost estimates along the planning and implementation process, based on a detailed analysis of potential costs, savings and income. Advance preparation is key - companies that leave the closure planning process too late are usually those whose cost burden ends up being the heaviest.

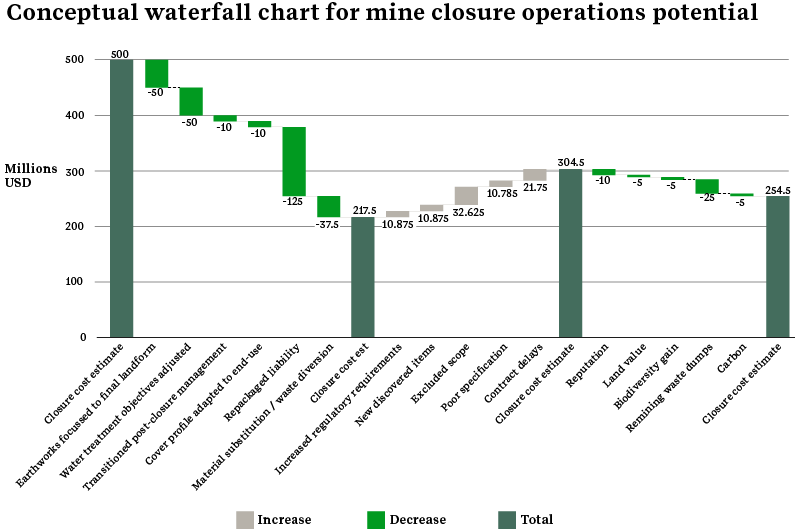

The waterfall chart below provides an example of the closure cost reduction elements, cost increasing factors and the value-added elements that could be applied to a mine closure programme if mining companies thought more strategically about closure, utilising the approaches set out above. Key to this is mining companies designing and operating with closure in mind and developing post-mining economies that provide opportunities for future stewardship of the land.

Source: ERM analysis

Companies can continue to refine their closure cost / income estimations and use these to drive cost projections to a more accurate position as closure programmes move towards implementation.

As mining sitesmines move towards closure, developing a better knowledge base reduces the level of cost uncertainty, as the closure team creates a more complete picture of the full range of probabilities relating to outcomes. Understanding the range of uncertainties in the cost estimate will allow companies to prioritize their effort on refining areas of the plan that will have the greatest impact on the final closure cost.

SiMinestes will need to test the assumptions in the basis of estimate to improve the accuracy of executing closure approaches to avoid costs increasing at a late stage due to unforeseen issues and to increase the likelihood of achieving successful closure outcomes, including environmental and social value.

The competing demands involved in mine closure mean solutions are far from straightforward and the complex and interconnected nature of the challenges can make issues difficult to solve. But companies that are open and willing to adopt a new mindset to mine closure planning and execution, that consider the site’s needs, the needs of the communities and regulatory requirements, will be best placed to achieve successful closure outcomes, unlock value and drive down closure costs.

Contact the authors:

Paul Hesketh - Associate Partner, EMEA

Paul.Hesketh@erm.com

Roberta Pedlar-Hobbs - Partner, North America

Roberta.Pedlar-Hobbs@erm.com