As countries around the world launch offshore wind tenders to meet their national decarbonization goals and as offshore wind markets mature, price is becoming just one of the selection criteria that developers need to compete on to win projects.

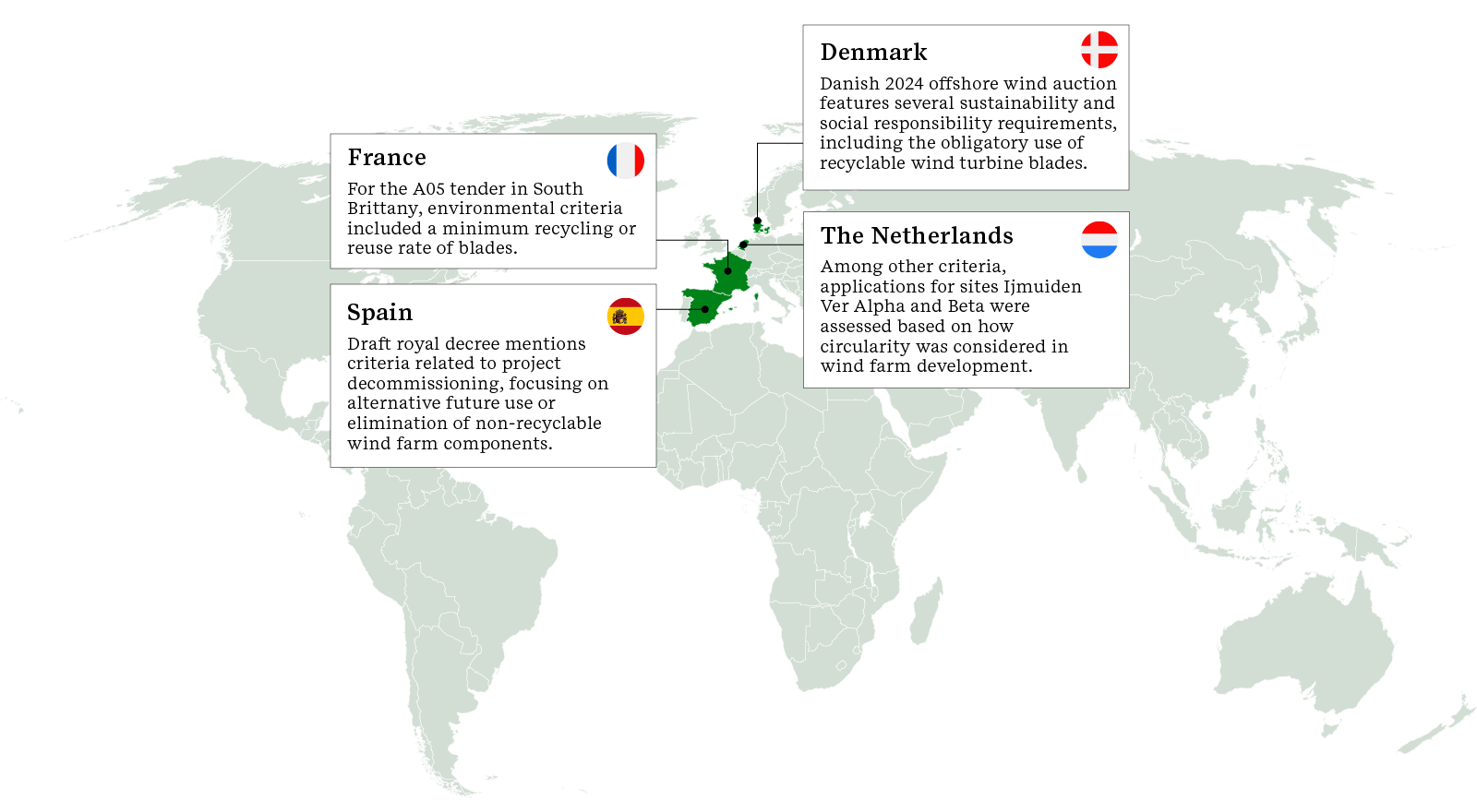

In the Netherlands, and increasingly across Europe and beyond, offshore wind auctions are also incorporating sustainability-related bid criteria, including circularity (see figure 1). The European Union (EU) is driving adoption of non-price criteria, recommending it be incorporated into offshore wind tenders for member states at weightings of at least 30% . Countries such as the UK and Australia are following suit, taking on board best practices from the EU model.

Figure 1: Map showing emerging circularity criteria in offshore wind tenders

Source: ERM analysis

As offshore wind markets in Asia and the Americas grow, ERM expects increasing global adoption of sustainability criteria for new projects, making non-price issues such as circularity a key consideration for developers wanting to remain competitive over the medium to long term.

Drivers of circularity criteria in EU offshore wind tenders

A range of issues relating to circularity and raw materials is likely to be included in forthcoming EU tenders. These are being driven by the following political, economic and environmental priorities in the region:

1. EU regulations promoting a circular economy

EU circularity regulations are increasing, with legislation such as the Circular Economy Action Plan, the Waste Framework Directive and the Critical Raw Materials Act informing national circularity plans, including a Dutch circularity roadmap.

The environmental benefits of extending use phases, recycling materials and repurposing components are a key concern for the EU, in terms of reducing both landfill demand and supply chain impacts. Recycled materials also offer a significantly lower carbon footprint compared to mined materials, with copper recycling, for example, saving 65% of CO2 emissions compared to mining.

By increasing the supply of secondary raw materials, circularity legislation also aims to reduce the EU’s economic dependence on raw materials from outside of Europe.

2. Raw material demand and scarcity

As the global clean energy transition drives demand for critical minerals such as copper, nickel, rare earths, cobalt and lithium, scarcity is incentivizing industries to improve the efficiency of their materials use and increase their recovery of resources from end-of-life assets.

Shortages of raw materials and resulting price rises offer the opportunity to create a secondary raw materials market and help recycling processes to become more economically viable.

3. Calls for a Europe-wide ban on landfilling turbine blades

While many components of wind turbine generators can today already be widely recycled, the industry still faces challenges to reuse, recover or recycle resources from wind turbine blades. WindEurope, a key European association representing the sector, expects around 25,000 tonnes of blades to reach the end of their operational life annually in Europe by 2025, doubling to 52,000 tonnes by 2030. A total of 43 million tonnes of landfill waste is expected to be generated by turbine blades globally by 2050.

WindEurope has highlighted the industry’s commitment to tackling this challenge, calling for a Europe-wide landfill ban on decommissioned wind turbine blades by 2025, while Germany, the Netherlands, Austria and Finland have already banned landfilling blades.

Upcoming circularity tender criteria

Although the level of detail and weight attributed to auction criteria differs across markets, developers can proactively anticipate and prepare for the upcoming changes.

To be able to meet expected and future circularity tender criteria in Europe and potentially across the globe, wind project developers should examine their current performance on the following aspects of circular design, raw materials and greenhouse gas emissions:

- How can circular design be used to extend the lifespan of wind farm projects and improve reuse and recycling of wind farm components?

- What amount of green steel and recycled steel is in the wind farm components and how much can be recycled?

- How much waste can be reused or recycled?

- How much primary/secondary critical and strategic raw minerals are contained in wind farm components and how much can reused or recycled?

- To what extent can alternative materials that show better performance with respect to reuse and recycling be used and how?

- What is the greenhouse gas footprint of the wind farm over its entire lifetime, from cradle to grave?

How to respond to the expected criteria

Wind project developers will need to integrate circularity into their activities to remain competitive in future tenders. To compare favorably with respect to circularity tender criteria, developers can initiate the following actions to improve their performance:

While business case considerations are currently top-of-mind for most offshore wind project developers and cost concerns may be dominant in the short run, non-price qualitative aspects of offshore wind projects such as life-cycle impact and circularity are expected to be key to winning future tenders in an increasing number of geographies. Developers that start to improve their performance now with respect to these sustainability parameters across project installation, operation and decommissioning stand to gain future competitive advantage across the globe.