Increasing climate-related risks, such as more frequent extreme weather events and financial risks related to the low carbon transition, are causing mounting pressure on the insurance industry to improve its disclosure of climate risk management. However, improving climate risk disclosure is not straightforward and beset by challenges such as data quality and investment attribution.

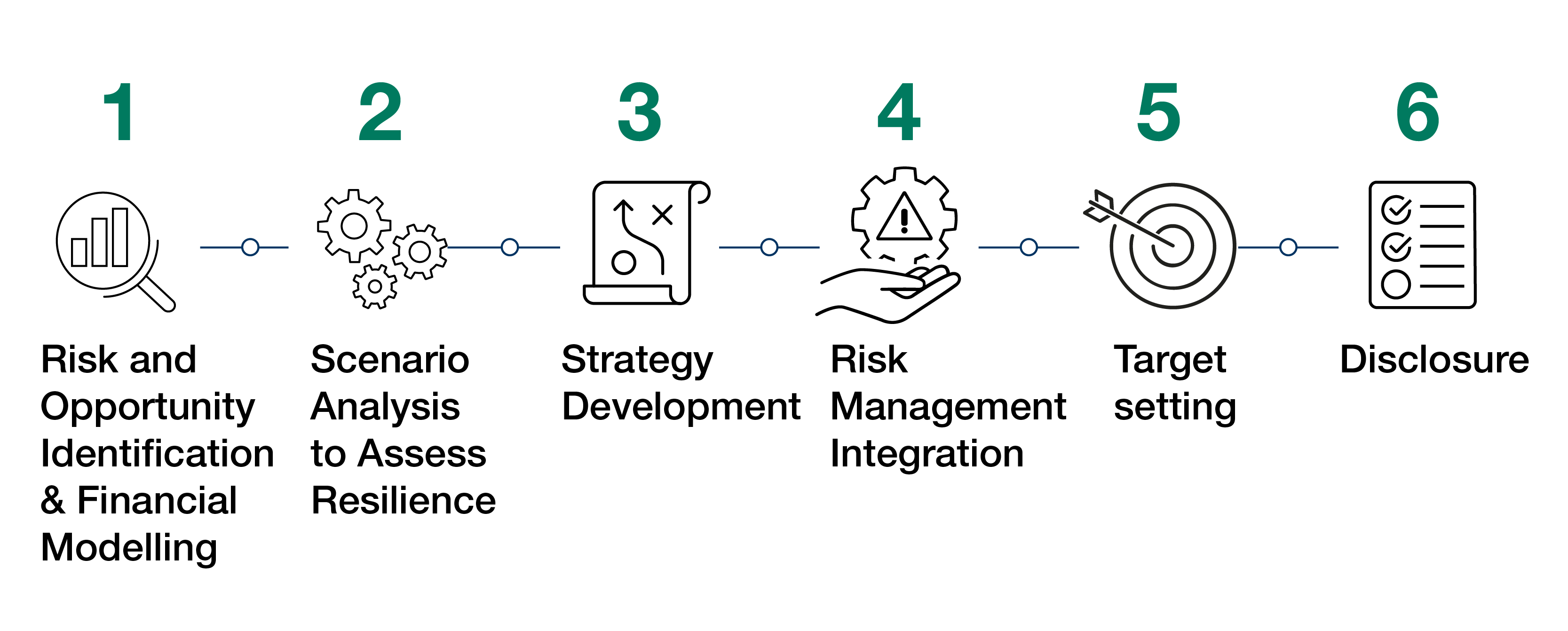

To provide a path forward in the context of new regulatory guidance, ERM has developed a holistic approach through six steps to help US insurance companies understand their current level of climate risk reporting maturity and develop their response to new US climate risk reporting recommendations for the insurance industry.

Navigating climate risk

Few industries are more familiar with the importance of risk management than the insurance sector. Risk identification and management is an inherent capability of the industry and is deeply embedded in underwriting processes and investment decisions. Those strengths have perhaps never been more important in the context of the impact of climate change, which today poses the single biggest risk to insurance companies. In 2022, 18 weather/climate disaster events, with losses exceeding USD one billion each, affected the United States.

According to a global survey of the insurance industry, climate risk was considered critical to portfolio construction and asset allocation by 95% of the respondents. Insurance companies are already taking a number of actions to manage climate change and support the transition to a low carbon economy. One priority is making sustainable investment mainstream by aligning climate-related risks with investment decisions, transitioning investment portfolios to net zero emissions, and engaging with portfolio companies on how to better manage and disclose their climate performance. This goes hand in hand with measuring and mitigating greenhouse gas (GHG) emissions from operations. Typically, insurers have a small Scope 1 and 2 footprint. However, Scope 3 emissions can form a significant portion of the emissions footprint.

The evolving climate reporting landscape

A challenge faced by insurers until recently in stepping up climate action had been the absence of a global and standardized measurement and reporting methodology to measure and report GHG emissions associated with investment and underwriting portfolios or target-setting. The Partnership for Carbon Accounting Financials (PCAF), along with the Net Zero Insurance Alliance (NZIA), released the Global GHG Accounting and Reporting Standard for Insurance-Associated Emissions in November 2022 to help companies measure and disclose GHG emissions associated with insurance and reinsurance underwriting portfolios. Even with the release of these guidance documents, companies will face challenges such as the availability of quality data, appropriate attribution of investment and underwriting portfolios, and double counting, leading to low-quality outputs limiting meaningful action and robust reporting.

However, making the effort to improve reporting can help insurers get ahead of the game. Investors and regulatory agencies are already asking insurance companies to make climate reporting more transparent, comprehensive, and aligned with the Task Force on Climate-Related Disclosures (TCFD) recommendations. The TCFD recommendations have emerged as the preferred framework for climate risk management and disclosure, and are being supported by several private sector organizations including financial institutions, regulators and governmental entities. Brazil, the European Union, Hong Kong, Japan, New Zealand, Singapore, Switzerland, and the United Kingdom have announced requirements for domestic organizations to report in alignment with the TCFD recommendations.

TCFD-aligned reporting requirements for the US insurance industry

The insurance industry in the US is one of the largest in the world, consisting of more than 7,000 companies with net premium written totaling approximately USD 1.4 trillion in 2021. The industry is regulated by a combination of varying state-based and federal requirements, making compliance challenging for companies. A key climate reporting guidance for the US insurance industry is the State Climate Risk Disclosure Survey of the National Association of Insurance Commissioners (NAIC). The NAIC adopted the Climate Risk Disclosure Survey in 2010 as a voluntary risk management tool for state insurance regulators to request from insurers, on an annual basis, a non-confidential disclosure of the insurers’ assessment and management of their climate-related risks. As of 2021, there are 15 states participating in the survey.

In April 2022, the NAIC adopted a revised State Climate Risk Disclosure Survey which aligned with the recommendations of the TCFD. As a result, the number of US insurance companies that will need to issue a report compliant with TCFD requirements will increase significantly. Insurance companies are expected to produce a report addressing the entire survey content by the end of August 2023.

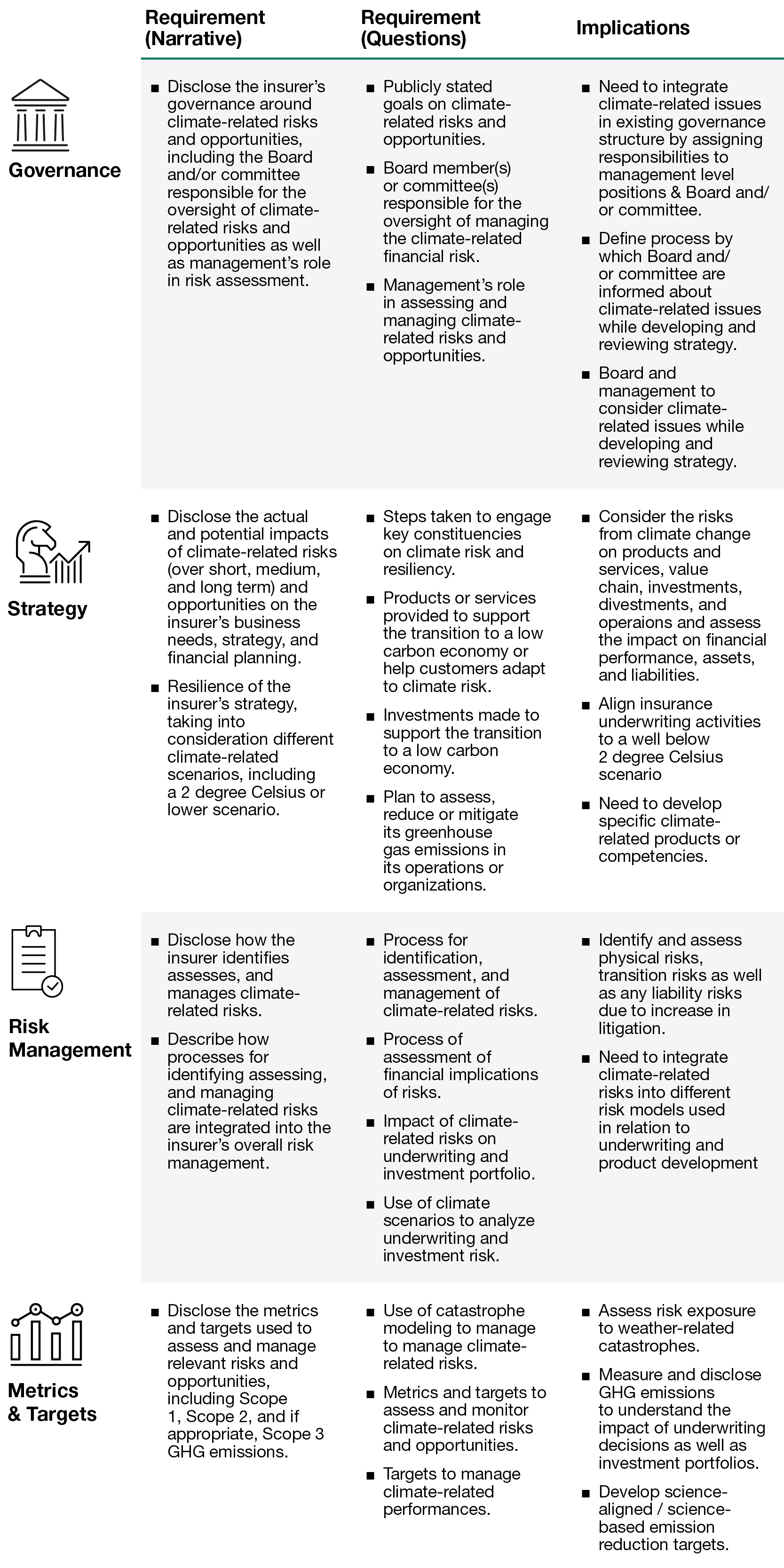

The revised NAIC survey includes narrative and close-ended questions, summarized below, which are grouped into the four themes of TCFD, Governance, Strategy, Risk Management, and Metrics & Targets:

How to improve climate risk management and meet reporting demands

How companies respond to the new demands of the NAIC climate survey in the United States will depend on the level of maturity and ambition of their current reporting system as well as their level of implementation of the TCFD recommendations.

Companies that already have a robust TCFD alignment program will need to consider how to develop informed, consistent, and comparable disclosure that provides a complete picture of how they manage their climate-related risks and opportunities. Companies that are committed to aligning to the State Climate Risk Disclosure Survey, but have not yet created a mature climate reporting system will need to map how their current practices align with the recommendations of TCFD and requirements of the NAIC.

Regardless of where a company is with its reporting, there are six major areas that will need attention in order to disclose against the revised NAIC survey requirements:

1. Risk and Opportunity Identification & Financial Modelling

Identify climate-related risks and opportunities potentially affecting the business, assess the potential financial impact, and prioritize by potential business impact.

Starting this journey requires engagement with a company’s Board and other key senior executives to get their buy-in and enhance understanding of climate impacts. Insurance companies should look to define a process to understand, prioritize, and manage the financial impacts of climate change (physical and transition risks) over a short, medium, and long-term horizon. Those that are already leading here can go further, focusing not only on managing the climate-related impacts across value chains, but also on aligning their products and portfolios to drive climate action.

2. Scenario Analysis to Assess Resilience

Deploy scenario analysis to better understand the timing and scale of future uncertainties.

The NAIC Climate Risk Disclosure Survey requires all companies to test the resilience of their business and portfolio by considering probable futures including a business as usual and lower than 2-degree Celsius scenario to understand how risks manifest in the future. Companies conducting scenario analysis for the first time may choose relevant publicly available scenarios. In line with their maturity, insurance companies can move onto sophisticated quantitative scenarios built in-house, that are more specific and granular. During COP27, ERM unveiled its enhanced approach to assessing climate-related risks and opportunities. A Better Blueprint for Corporate Climate Analysis explores ways to understand and implement innovative climate scenario analysis and is designed to engage stakeholders at the most senior levels within companies.

3. Strategy Development

Take action on strategic responses to mitigate risk.

Companies across the maturity spectrum will need to implement a number of initiatives to mitigate risks. Leaders in this area will be able to collaborate with peers and other stakeholders to further drive widespread change.

4. Risk Management Integration

Embed climate-related risks into the existing Enterprise Risk Management and strategy development processes.

Insurance companies placed at the beginning of the maturity curve should focus on identifying climate-related risks and opportunities. Companies with well-defined processes for risk identification and management should bring climate-related risks and opportunities into the ambit of principles and practices of their existing enterprise risk management framework.

5. Metrics and Targets

Develop a suite of consistent and comparable metrics & targets (including GHG emissions) to measure progress, baseline GHG inventory, and set decarbonization targets.

Insurance companies that have not yet started this work should look to identify key metrics to track in line with its strategy, risks and opportunities. Those insurance companies focusing on limited disclosure can look at calculating GHG emissions from their operations (Scope 1 and 2). These initiatives are required to be supplemented by establishing data management systems to collect and track relevant data. Companies that have this in place will be able to focus on the more complicated areas of Scope 3 accounting, target-setting, including Science-based targets, tracking performance against targets, assurance of reported data, and public disclosure. The NZIA published its first target-setting guidance protocol during the World Economic Forum this year, allowing NZIA members to begin to set science-based decarbonization targets for their insurance and underwriting portfolios.

6. Disclosure

Identify gaps in external reporting and internal processes according to selected reporting frameworks and develop climate-related disclosures to position the organization favorably compared to peers and promote investor confidence.

Initiating disclosure is the immediate need for companies beginning this journey. Their action plans should include understanding the reporting requirements, reporting on relevant information, and putting together a roadmap for continuous improvement of public disclosures in collaboration with relevant departments. Mature companies with robust reporting systems can focus on disclosing more detailed information and demonstrate their sustainability leadership through good practices.

This holistic process can help insurance companies embed climate change into risk management process and strategy, which addresses compliance requirements while creating value for its stakeholders. Organizations in the sector range from Fortune 500 companies to regional and local insurers – with such different profiles, there is no one size fits all solution.

It’s critical that organizations have both a clear picture of the reporting landscape, and where they fit in it – from their own readiness for reporting to disclosing effectively. Taking a modular approach such as the one outlined above would allow insurance companies to choose the right actions based on their maturity and ambition, helping them to manage the risks and opportunities of the transition to a low carbon economy.