2023 will be a transition year for integrating sustainability into mainstream business and investment practices, driven by increasing ESG regulation, targets and disclosure requirements. Here are four key trends from the ERM Sustainability Institute’s 2023 Trends Report that are driving this transition:

Corporate ESG disclosure will become more standardized across geographies and sectors

Inconsistent ESG data availability and quality hinder corporate ESG efforts and impact. In June 2021, the International Organization of Securities Commissions (IOSCO) published a report finding that investor demand for consistent and comparable sustainability disclosures was not being met. It identified three priorities to improve sustainability reporting: (1) encouraging globally consistent standards, (2) promoting comparable metrics and narratives, and (3) coordinating across approaches.

Consistent with IOSCO’s recommendation, the International Financial Reporting Standards (IFRS) Foundation established the International Sustainability Standards Board (ISSB) in November 2021. The US Securities and Exchange Commission (SEC) published draft climate disclosure rules in early 2022 which are expected to be finalized this year, while the EU’s European Financial Reporting Advisory Group (EFRAG) has begun rolling out its European Sustainability Reporting Standards (ESRS) disclosure rules, and the IFRS organization has published proposed sustainability disclosure standards.

While the SEC, EFRAG, and ISSB proposals deal with similar material, they differ in certain respects, including their enforceability, jurisdictional scope, substantive scope of coverage, and detailed requirements.

Nature-related disclosure will also advance in 2023. The Taskforce on Nature-related Financial Disclosures will provide companies with a framework for nature-related assessment and disclosure, with the full framework expected to be ready for market adoption in fall 2023. With respect to net zero ambitions, the Science Based Targets initiative continues to develop net zero frameworks like the Net Zero for Financial Institutions standard.

These advances will enable more consistent ESG disclosure by companies. To prepare for this move toward consistency, companies should align their ESG activity with major frameworks and guidelines now to ensure future readiness and compatibility.

Growing challenges like scoring discrepancy will amplify calls for ESG ratings regulation

ESG ratings have seen increased uptake alongside growth in ESG investing; as more ESG funds are brought to market they will likely undergo increased scrutiny from regulators and investors. Over the past few years, use of ESG ratings has increased such that nearly 90 percent of all stocks in the S&P 500 have been included in ESG funds constructed using MSCI ratings. Still, while the number of ESG ratings continues to grow, there remain significant differences between the scores different ratings agencies assign the companies they cover. A 2021 study found that correlation between scores from six prominent ratings agencies was only 0.61, which is in sharp contrast to the high correlation of credit ratings, which often find alignment upwards of 0.95. Findings from ERM’s latest Rate the Raters report indicate that this lack of consistency and comparability across ratings is an issue that corporate issuers and investors are anxious to see resolved.

Regulatory bodies have begun to address some of these issues. In June 2022, French regulator Autorité des Marchés Financiers called for a regulatory framework for ESG ratings and data providers in response to a European Commission initiative aimed at increasing “the reliability, trust, and comparability of ESG ratings by early 2023.” Similarly, in November 2022, the UK’s Financial Conduct Authority formed a panel to develop a Code of Conduct for ESG ratings and data providers. Outside of Europe, India’s Securities and Exchange Board sought feedback on a January proposal to review the accreditation of ESG ratings providers every two years. With governing bodies taking the first steps toward regulating ESG ratings and data providers, companies should engage with ESG ratings agencies to better understand how they evaluate their business so that they can better align their disclosures with external expectations.

Companies’ ESG goals will impact suppliers

In addition to the way businesses depend on their supply chains to help deliver on their ESG goals, many companies are requiring suppliers to set and meet ESG goals of their own. For example, General Motors’ new Environmental, Social, and Governance Partnership Pledge requests that suppliers achieve carbon neutrality for Scope 1 and 2 greenhouse gas emissions and attain specific EcoVadis scores for issues such as diversity and non-discrimination, child and forced labor, and corruption and anticompetitive practices by 2025.149 GM suppliers representing over half of the company’s multibillion dollar direct material annual purchase value have already signed on to the pledge. Similarly, Deutsche Bank will require all its major suppliers to undergo an ESG assessment from one of a group of ESG ratings providers (EcoVadis, MSCI ESG, Sustainalytics, ISS ESG, S&P Global, and CDP) to ensure their suppliers have strong ESG practices. For Deutsche Bank suppliers assessed by EcoVadis next year, the bank will only grant contracts worth over $530,633 to vendors who achieve a sustainability rating of at least 25 out of 100 possible points.

If not planning to do so already, companies should begin setting ESG standards for suppliers to amplify and accelerate ESG progress. After setting ESG standards, companies should help suppliers meet the new requirements by sharing the knowledge and experience they have gained on their own ESG journeys. Companies who are required to meet these ESG requirements should work closely with their partners setting these requirements to ensure they understand what is required of them and that they are able to meet them in the timeframe required.

Investor interest in corporate DEI practices will increase

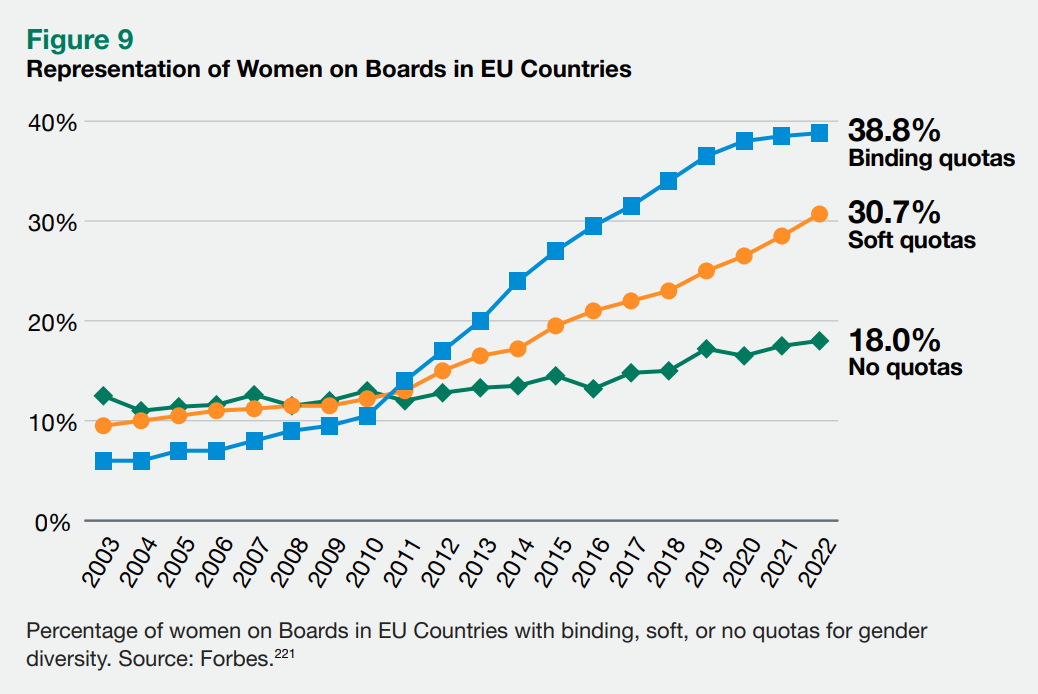

Many companies have already dramatically increased their DEI efforts. In the EU, efforts to increase board diversity were boosted after the EU Council approved a law to improve board gender balance by requiring that 40 percent of non-executive directors of public EU companies must be members of the underrepresented sex by 2026. This rule should have a positive impact on overall diversity, equity, and inclusion outcomes at companies. A 2022 study found that representation of under-represented groups at staff and manager levels at assessed S&P 1500 companies increased significantly when board diversity improved.

Investors seem poised to follow suit. In March 2022, the Investor Leadership Network (ILN), a global investor organization with over $10 trillion in assets under management, published its Inclusive Finance Playbook. Through the Playbook, the ILN aims to help institutional investors evaluate and engage their portfolios on inclusion-related issues. The same month, private equity firm The Carlyle Group formed the Carlyle DEI Leadership Network to strengthen the DEI strategies and goals of its portfolio companies. The Network provides tools to support DEI journeys, including an annual meeting for portfolio company CEOs to learn from experts and share successes and challenges, and a quarterly speaker series for portfolio company employees. One notable regulatory development came out of the UK where the Financial Conduct Authority, the UK regulator for financial service firms and financial markets, finalized rules requiring issuers to disclose if they comply with DEI-related targets, including having women make up at least 40 percent of their board and having at least one board member from a non-white ethnic group. As investor DEI interest continues to grow, companies will need to designate a person or team to frequently assess the DEI-related initiatives and positions of their largest investors to ensure their own practices align with the expectations of these stakeholders.

Read the full 2023 Trends Report for more sustainability trends insights.